Automation and the Future of Accounting

Do you know when the last innovation in accounting happened? It was in 1494, more than five centuries ago, when Luca Pacioli discovered the double entry bookkeeping. Finally, after hundreds of years something seems to be changing.

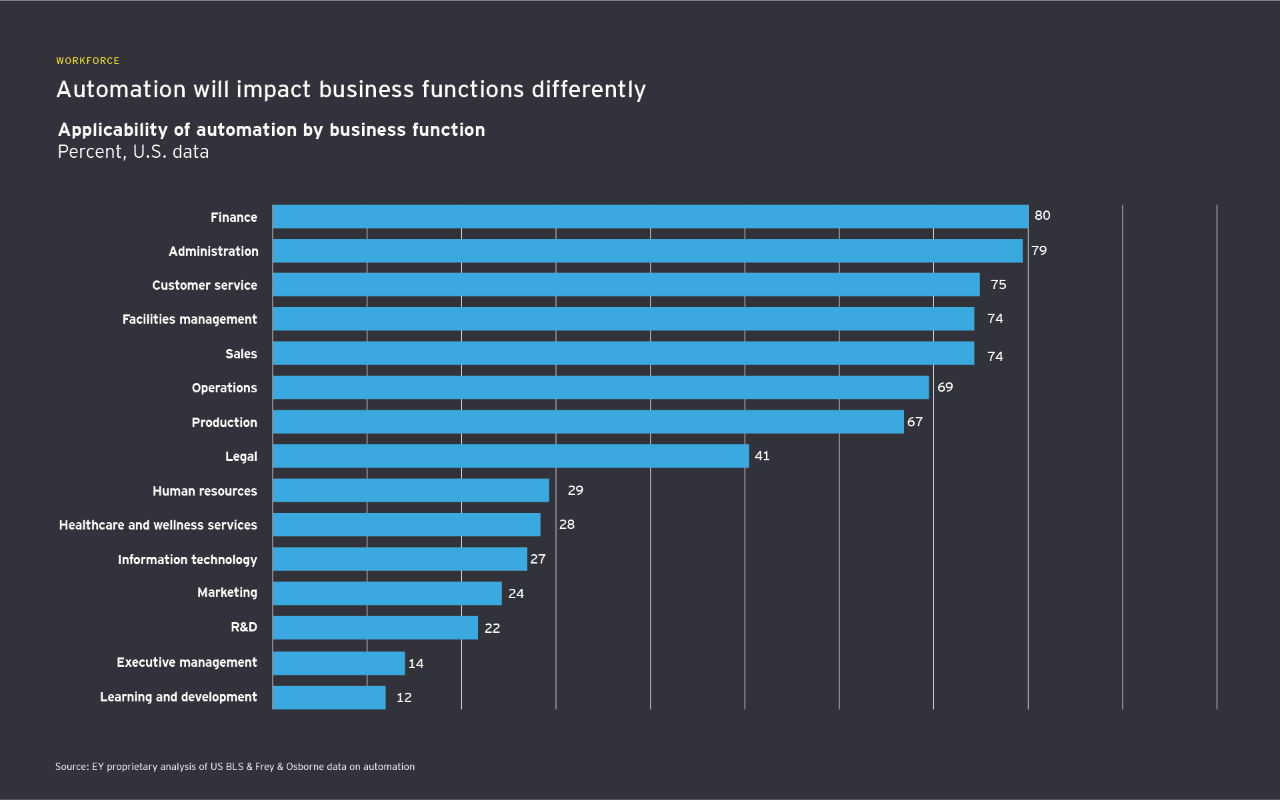

The developments in Artificial Intelligence and data science has opened new paths for businesses to generate ideas that could lead to significant productivity improvements.

86%

Compared to other professions that are affected by automation, accountants are spending the most time on tasks that probably can be automated.

What does it mean for future accountants?

With the advance of the technology it is clear that Artificial intelligence and automation are rising dramatically. Artificial intelligence is already automating tedious every-day tasks, such as data entry. That means that some jobs are going to be eliminated and some others to be created.

The majority of the high demand jobs did not even exist a decade ago. That means that by the time most children finish school, there will be a whole different picture for them regarding the job pool. They will possibly end up in jobs that do not even exist at the moment or are not widely known. It is estimated that around 35% of skills will be different in the near future.

According to Randstad Singapore, transactional roles like general ledger, accounts receivable and payable may be endangered, but other higher value tasks like financial planning and analysis or business controlling would still be in high demand.

So, even though the automation of accounting technological development is not going to eliminate the accountant’s profession, it will change it to a great extent.

However, the changes should not be too drastic. Accountants might need to be prepared to re-skill themselves or learn new skills, such as effective communication as well as funding, payments and new models for businesses.

After all, the accountant’s role has evolved over the years and it’s not only about adding the numbers, it involves financial planning and cost-saving guidance. This is something machines might not be able to do.

According to Oxford study, out of 366 jobs, accounting profession ranks 26th most likely to be automated.

What is automation?

People hear about automation and artificial intelligence and they think of robots or a science fiction Hollywood movie. In fact, things are not that complicated.

Automation in accounting takes most of the manual tasks of an accountant and does them automatically, removes the least efficient aspects of an accountant’s work and leaves more time for analysis. For example, somebody could instantly complete such a simple task as a cash cycle report from raw data. The technology automates high-volume, repeatable tasks without the possibility of errors. Needless to say it is the future of accountant’s profession.

Accounting automation does not focus only on financial management but rather on the entire accounting process. That means that the accountant can do many things automatically, and the dependence on manual transactional entries is minimized. If you are not afraid to acknowledge the advance of automation and AI, it can improve the decision making and high-level performance strategy in invoicing and bookkeeping.

We know for a fact that future improvements in Artificial Intelligence will provide numerous challenges for businesses and impact accounting as a profession in many ways.

Bob Kurpershoek, Director of Finance at NBCUniversal says:

“The volume is high, and the process is quite standardized.

A combination of these two makes the return on investment of putting a robot in place very positive.”

How will accounting be influenced by AI?

Efficiency is increased in accounting-related tasks as Artificial Intelligence is daily taking over more and more industries. Time consuming tasks and reports can be automated giving you the time to audit the automated data entry. Although for older generation bookkeepers and accountants it creates a feeling of uncertainty and fear.

If you are thinking of a robot taking over your job, it is not exactly like that. It simply helps businesses and professionals to do their job more efficiently such as running payroll, categorizing transactions, running financial reports or invoicing clients.

Let’s dive deeper into the possible outcomes of Artificial Intelligence in accounting.

1. Computer coded software

2. Programmes that replace human performing tasks

3. Cross-functional and cross-application Macros.

What they are used for:

To capture and process huge amounts of data information from applications in order to manipulate data, process transactions and communicate across systems.

Skills:

1. Analyze raw data

2. Record and transport information and data

3. Calculate and decide what to do according to inserted variables.

4. Communicate and assist users

5. Organize and manage activities

6. Monitor, detect and report operational performance

7. Learn, anticipate and forecast.

Salika Suksuwan, Human Capital Leader of PwC Malaysia:

“It’s a rather simplistic view of accountants’ role if we were to think that the profession will be taken over by machines. Automation brings greater opportunities for the profession as it helps reduce transactional and routine tasks such as data entry, bookkeeping and compliance work, and allows accounting and finance professionals to focus more on value-added services. These include advising clients and providing strategic insights on critical financial transactions.”

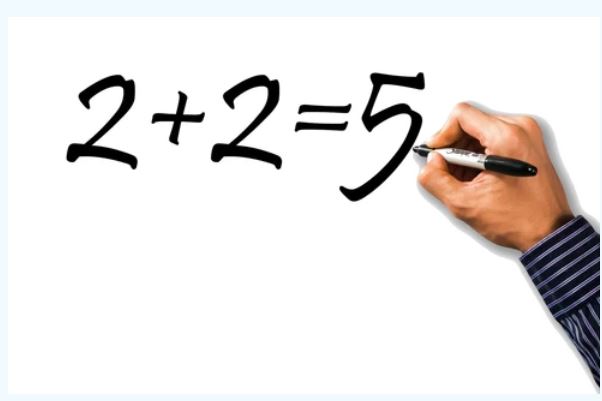

The human mistake factor

Let’s face it, human errors in accounting cause a lot of problems. How many times you ended up looking at numbers that wouldn’t add up because you forgot or failed to include a row? Automation solves all of those problems. Routine is one of the main factors of human errors, because repeating the same task over and over again might get you to forget to change a number, a date, or the supplier.

Accountants can reduce many of their tasks using automation, and that frees them up to take on more important tasks. And, of course, it helps reduce mental stress and frustration related to deadlines. You can end up focusing on high-value tasks and avoid monotonous tasks and boring data entries.

“The greatest thing in this world is not so much where we stand as in what direction we are moving.”

Maybe your accounting firm is doing just fine without automation. After all you have been able to get by without it for a long time already. But it seems that accounting is evolving, and you have to prepare for the future of your business. The automation will not replace accountants, but it will change their tasks, make their life easier, possibly change the required skill set for future accountants. Truth is, automation is a lot faster and more accurate than any of your best employees.

A daily task that requires one hour for an accountant to complete it might demand only a second for an AI to complete it. The benefits of automation in accounting are numerous.

After all you do not want to overpay work hours for underrated tasks. Accounting automation and the use of artificial intelligence for the financial industry is only in their primary phase. There are so many more technologies and trends to be adopted and discovered. Bringing the right automated solution into your firm is essential for your future.

By failing to prepare, you are preparing to fail

The automation of accounting transactions is inevitable, and accountants have to constantly stay relevant by providing value-add to the business constantly.

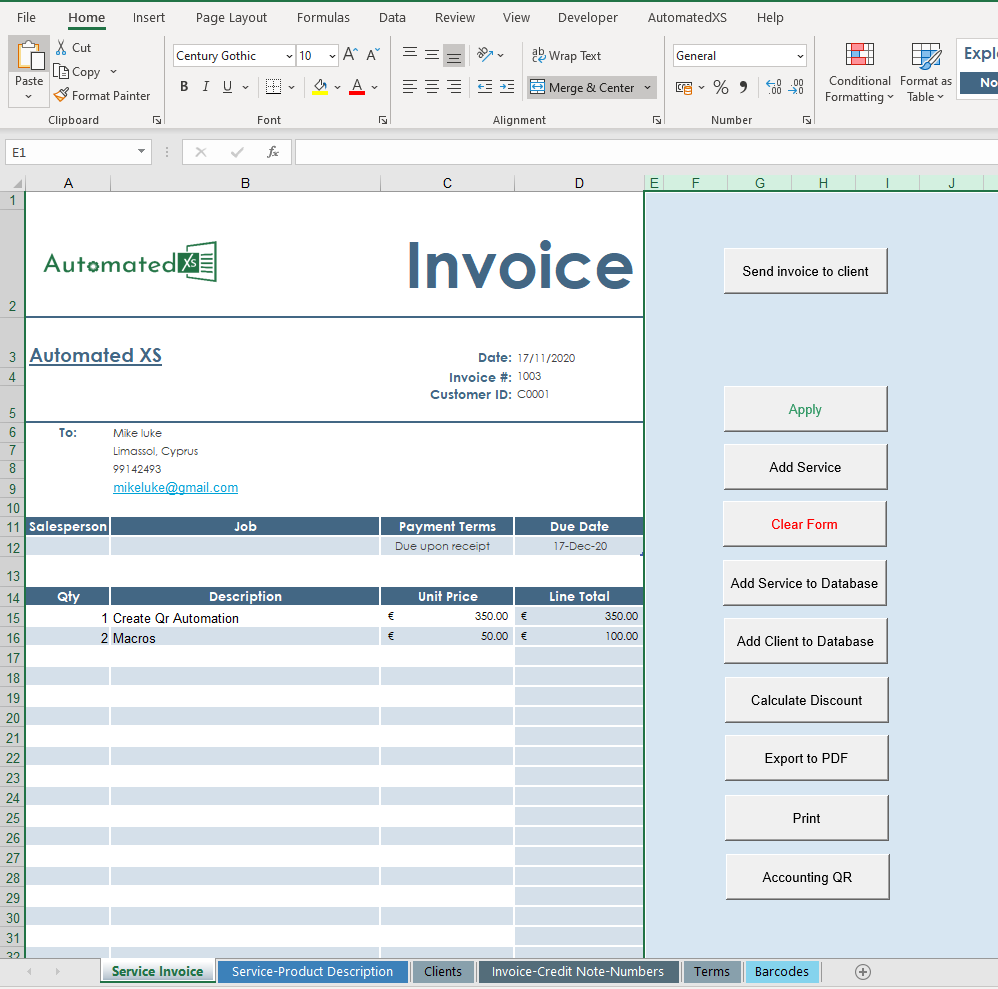

That’s where we at AutomatedXS come in. We work with you to determine which tasks can be automated, we organize, manipulate analyze and present data. We create and automate your spreadsheets by using macros and formulas, we create Excel bots, create forms, saving you time and, of course, money.

If you want to know more about the tasks that could be automated, feel free to book a Free Consultation with us here in Automated XS.

Find us on our social-media channels.